Oil prices have moved higher after Iran sent a warship into the Red Sea in response to the sinking of three ships by the US Navy.

Iran despatched its Alborz destroyer on Monday after the sinking of three Houthi boats over the weekend in the vital trade route, which is being avoided by shipping companies after a series of attacks.

5 things to start your day

1) Hedge funds stockpile uranium as price of nuclear fuel surges | Up to 50 firms are believed to have bought ‘yellowcake’ amid huge global supply deficit

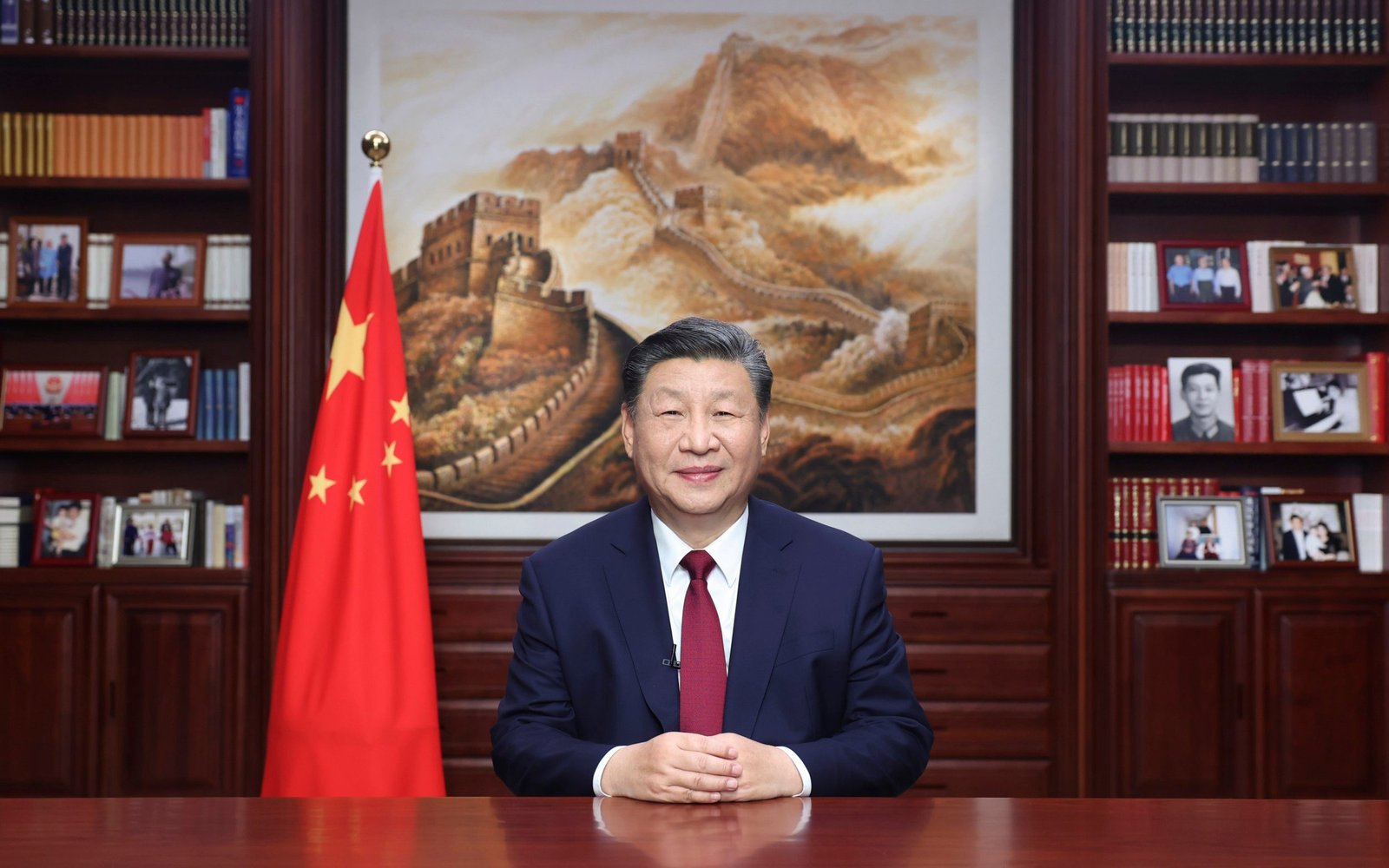

2) Britain cracks down on semiconductor sales to China | Western countries continue to restrict Beijing’s access to advanced microchips

3) Investors lose £7bn on British banks despite rising interest rates | Barclays, NatWest, Virgin Money and Metro shares all failed to make gains since January

4) Falling food inflation at risk from looming cost pressures | ‘Obstacles on the road’ threaten to stoke price rises in 2024, warn retail bosses

5) Defence company founded by Oculus creator plans to double UK presence | Anduril bets on a boom in Britain’s aerospace technology

What happened overnight

Asian markets slipped as traders returned from the New Year break.

Wall Street had ticked lower on the last trading day of 2023 and the Hang Seng index in Hong Kong began 2024 by sinking 1.5pc to 16,800.73.

The Shanghai Composite index dropped 0.2pc to 2,968.81. Japan’s markets were closed for a holiday.

Investors were selling property developers like debt-laden China Evergrande, which fell 6pc, and LongFor Group Holding, which lost 5.7pc.

The December survey of the official purchasing managers index, or PMI, in China fell to 49 for the third consecutive month, signalling weak demand and underscoring the challenging economic conditions in the world’s second-largest economy.

That contrasted private-sector survey, by financial publication Caixin, which registered a slight improvement in the manufacturing PMI to 50.8, driven by increased output and new orders. However, it showed that business confidence for 2024 remained subdued.

South Korea’s Kospi shed 0.2pc to 2,651.34 and the S&P/ASX 200 in Australia rose 0.5pc to 7,625.60.

Bangkok’s SET rose 0.2pc and the Sensex in Mumbai climbed less than 0.1pc.

Stocks fell Friday on Wall Street from their near all-time high amid easing inflation, a resilient economy and the prospect of lower interest rates which buoyed investors.

More about this article: Read More

Source: www.telegraph.co.uk

This notice was published: 2024-01-02 09:12:39