Europe’s largest fintech company has backed UK efforts to diverge from EU financial regulations, saying the UK has the opportunity to tear up the bureaucracy.

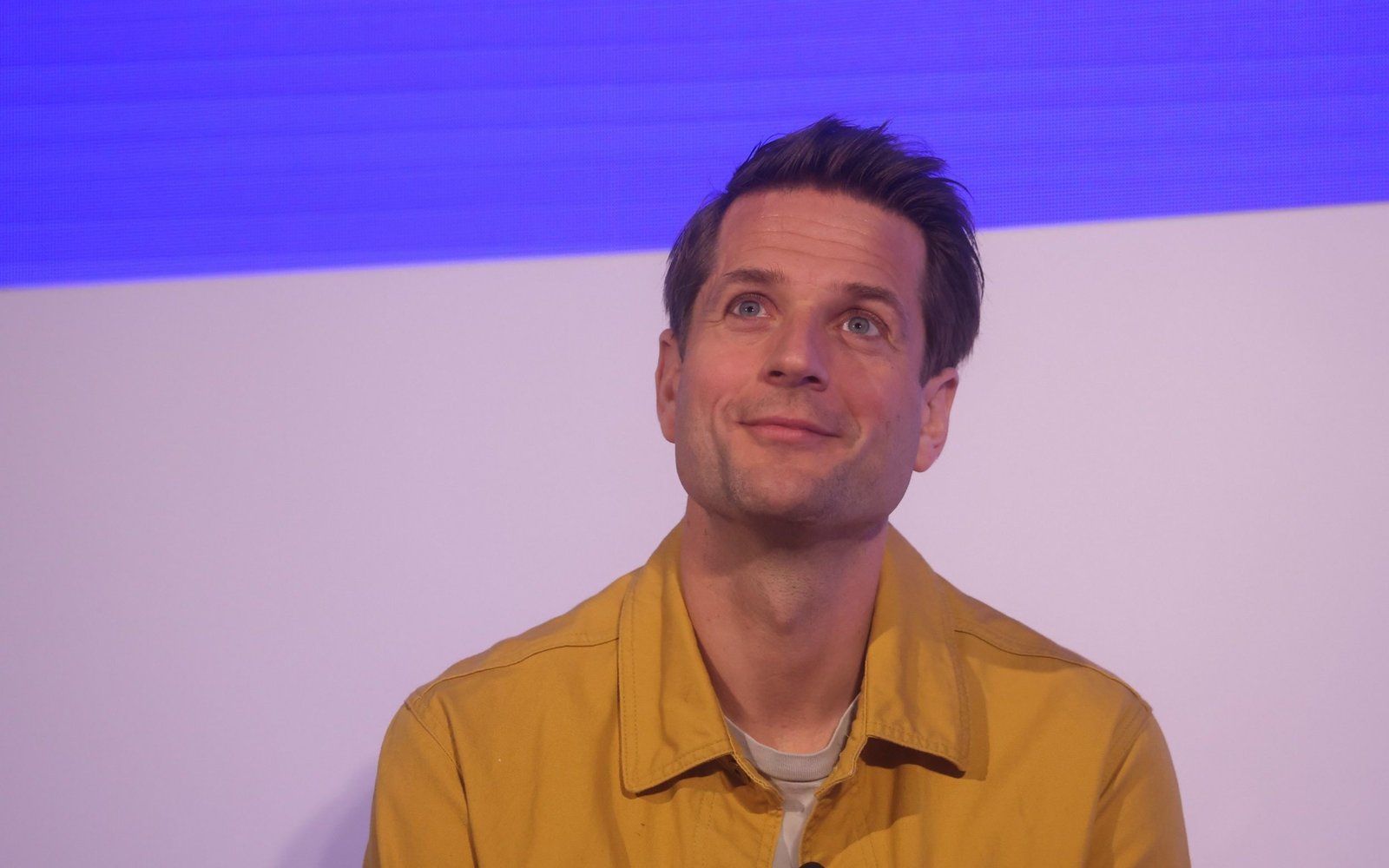

Sebastian Siemiatkowski, chief executive of Klarna, said Britain now had the chance to write “results-based regulation” and ignore some of the “bad practice” in Brussels law.

It comes as Stockholm-based Klarna, which was valued at $45.6bn (£35bn) last year, is eyeing Britain as one of the potential destinations for bumper flotation.

“Unfortunately, I was not blown away by Brussels,” Mr Siemiatkowski told the Innovate Finance Global Summit in London.

“I think Know Your Customer and AML [anti-money laundering] is the worst regulation ever created. It’s so prescriptive, it’s poor. It does not serve this purpose.

“What I have seen in the UK that makes me very excited, although people have different opinions on Brexit, as you are now gone, what I feel is this incredible momentum and willingness to eliminate some of the bad practices from Brussels and Europe, and actually write results-based regulation that keeps in mind that the strongest force is the customer.

Mr Siemiatkowski said he supported regulation that “leaves the industry to innovate… otherwise what you are doing is reducing customer mobility and protecting the profitability of banks as they are”.

Klarna is best known in the UK for its “buy now, pay later” service, which allows shoppers to pay for items over 90 days.

The Financial Conduct Authority recently ordered Klarna and other providers to buy now pay later to change their terms, while the government is working on legislation to regulate the industry. Mr. Siemiatkowski said he supported the efforts.

He added that the rise of fintech such as open banking would significantly reduce the profitability of traditional finance, as consumers could instantly switch between products to drive down prices.

“This industry. We have all imposed too much money on society for services that do not really benefit society. We are going to move towards a market with less profit, where financial services really serve consumers,” Mr. Siemiatkowski said.

More about this article: Read More

Source: www.telegraph.co.uk

This notice was published: 2022-04-04 16:52:14