The UK faces a recession with inflation set to hit its highest rate since 1982, the Bank of England has warned.

The Bank raised interest rates from 0.25% to 1% on Thursday in a bid to temper the soaring cost of living and warned the economy was likely to contract in the final quarter of the year.

Although the central bank’s Monetary Policy Committee (MPC) did not formally predict a recession, the move increased the likelihood of the economy contracting.

The following three charts explain the impending economic turmoil in the UK.

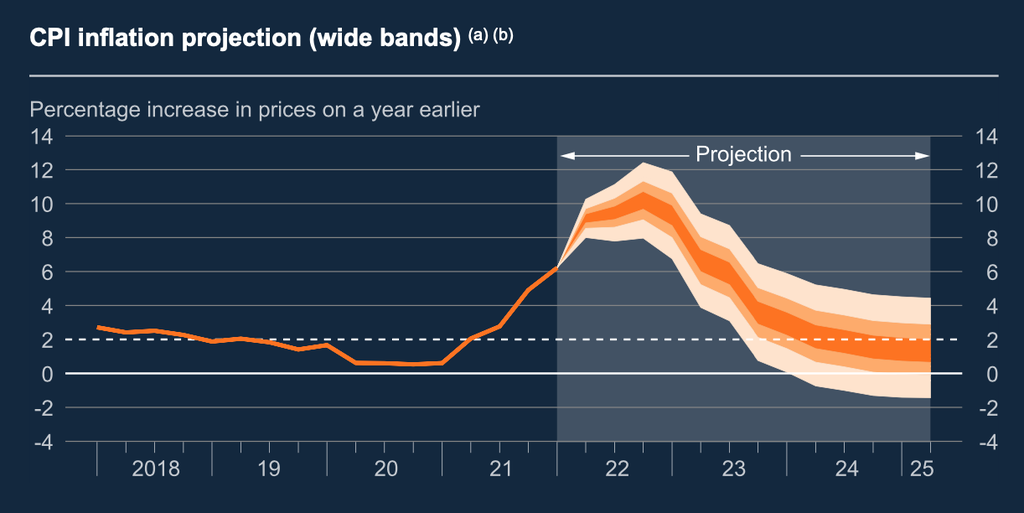

Inflation soars

Inflation will hit double digits by the end of 2022 – the highest rate in 40 years – as millions face an unprecedented spike in energy bills and the second biggest drop standard of living since records began.

(Bank of England)

A further 40% hike in the energy price cap is then expected in October, according to the Bank of England, to deal with soaring wholesale energy prices caused by President Vladimir Putin’s war in Ukraine.

The price cap will see inflation peak later in the UK compared to other countries, prompting the Bank of England to warn it could come down more gradually.

Average bills for gas, electricity, prices for food and other essentials are all expected to continue to rise, the bank’s MPC said on Thursday.

GDP growth stagnates

The economy is expected to contract in 2023 after a deterioration in the last quarter of this year. The Bank forecast growth of 1.25 percent next year, but now says output will fall 0.25 percent instead.

(Bank of England)

The chart predicts near-stagnant growth for three years – with the Bank predicting zero growth in 2023, followed by 0.2% in 2024 and 0.7% in 2025.

While the central bank forecasts a 10% rise in inflation and a 1% fall in GDP growth for the last quarter of 2022, the projection seems to meet the objective of “stagflation”.

The figures will put pressure on Chancellor Rishi Sunak to provide more support to struggling families.

Unemployment will soar

As inflation falls, unemployment will rise, the Bank predicts.

(Bank of England)

Although the UK labor market has recovered to pre-pandemic levels in recent months, thanks to the lifting of Covid restrictions and the resulting improved economic outlook, unemployment is set to rise as the impending economic disaster looms large over the tip of his nose.

The Bank of England is warning that unemployment could rise by 8% by 2025 – the worst level since the end of the banking crisis.

His baseline forecast is for unemployment to rise from 3.9% to 5.5% in three years, which would leave about 450,000 more people out of work.

More about this article: Read More

Source: www.independent.co.uk

This notice was published: 2022-05-05 23:14:58